10 Cost Optimization Strategies For Private Equity Portfolio Companies

- Jon White

- Jun 30, 2023

- 9 min read

Updated: Aug 25, 2023

Introduction

Private equity companies play a crucial role in the financial landscape, providing capital and expertise to foster growth and value creation in portfolio companies (PortCos). These firms invest in diverse businesses across industries, often focusing on high-potential companies with growth prospects.

The relationship between private equity firms and their portfolio companies extends beyond mere financial investment, as in most cases, they actively work together to navigate challenges and drive success. In times of economic uncertainty and adversity, private equity companies aim to provide valuable support to their portfolio companies, leveraging their experience, resources, and strategic guidance to weather the storm and emerge stronger.

There are three lenses through which value creation typically looks: revenue growth, EBITDA/Margin growth, and exit multiple potential. Cost optimization drives a company's EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and margin growth. Organizations can improve their profitability and operational efficiency by strategically identifying and reducing unnecessary costs, streamlining processes, and optimizing resource allocation with an eye to reducing costs and increasing revenue and company value.

During challenging economic periods, private equity companies understand the unique pressures and risks that portfolio companies face. They recognize the importance of resilience and adaptability and proactively offer assistance to help their portfolio companies overcome difficulties and seize opportunities.

Private equity firms work closely with portfolio companies to identify areas where costs can be optimized. They conduct comprehensive cost reviews, assess cost structures, and implement measures to reduce expenses without compromising quality. This includes scrutinizing procurement processes, renegotiating contracts with suppliers, and improving operational efficiencies. By optimizing costs, portfolio companies can improve their financial resilience and maintain profitability.

Following RingStone’s observations from the wealth of companies we get exposed to, this blog will explore ten cost optimization strategies employed by successful companies.

1. Identifying Cost Optimization Opportunities

PortCos should conduct comprehensive cost analysis, evaluate cost structures, identify inefficiencies, and pinpoint areas where cost-reduction measures can be implemented. It is essential to include stakeholders from different functional areas, such as finance, operations, and R&D, to gather valuable insights and develop an integrated approach.

2. Streamlining Operational Processes

Optimizing operational processes is a crucial aspect of cost reduction in the software industry. This involves identifying and eliminating redundant or non-value-added activities. Focus on process standardization, better R&D planning, product portfolio planning, optimizing the prioritization process, implementing lean methodologies, and fostering a culture of continuous improvement. By streamlining workflows and reducing process complexity, companies can save costs while improving overall operational efficiency.

3. Leveraging Technology and Automation

Technology plays a pivotal role in cost optimization for software industry companies. Investing in modern software tools, automation solutions (e.g., test automation), and digital transformation initiatives can all help drive cost efficiencies. By leveraging technology, companies can streamline manual tasks, improve productivity, and reduce human error. Automation can be applied to repetitive processes, such as data entry, testing, and deployment, freeing up resources for higher-value activities.

4. Rationalizing R&D Talent

Cost optimization can focus on talent management and workforce efficiency. Companies can identify skill gaps by conducting a thorough workforce assessment, reorganizing teams, right-sizing their workforce, and creating/optimizing the location strategy. Training and upskilling programs can also enhance employee productivity and reduce reliance on external consultants or contractors.

Companies can optimize resource allocation by matching the skills and expertise of R&D team members with project requirements. To be effective, avoid overstaffing or underutilizing resources, which can lead to unnecessary costs. Conduct regular resource assessments, including distributed teams' efficiency, to identify skill gaps and reallocate resources accordingly.

5. Exploring Outsourcing Opportunities

Outsourcing is particularly advantageous when it involves functions that are not directly related to a company's core competencies or value proposition. Non-core functions typically include IT support, payroll processing, customer service, human resources, accounting, and administrative tasks. By outsourcing these functions to specialized service providers, businesses can access expertise and economies of scale, reducing costs compared to handling them in-house.

Outsourcing can be a cost-effective solution when a company requires highly specialized skills that are not readily available or not economically feasible to develop internally. For instance, complex software development, data analytics, artificial intelligence, legal services, or specialized engineering expertise might be costly to maintain in-house. Outsourcing such functions to external providers who specialize in those areas can help reduce costs by leveraging their knowledge and avoiding the expenses of hiring and training specialized professionals.

Outsourcing to lower-cost regions or countries with a favorable labor market can offer significant cost advantages. Labor and operational costs can be substantially lower in areas with lower wages or reasonable exchange rates. Businesses can leverage these cost differences by outsourcing certain functions or processes to qualified service providers in those regions, reducing overall costs while maintaining or improving service quality.

There are documented best practices for making outsourcing work well to help avoid the pitfalls where there is a healthy return on investment and quality output.

6. Improving Vendor Management and Negotiation

Effective vendor management and negotiation can lead to significant cost savings for software industry companies. This includes consolidating vendor relationships, negotiating favorable contracts, and implementing vendor performance monitoring mechanisms. By optimizing vendor relationships, companies can secure better pricing, improve service levels, and reduce the risk of vendor lock-in.

Vendor management can leverage performance-based contracts to incentivize vendors to deliver cost-effective solutions. By structuring agreements with performance metrics tied to cost savings or efficiency targets, portfolio companies can align vendor incentives with their cost optimization goals. This encourages vendors to proactively seek ways to optimize costs, innovate, and continuously improve their service offerings.

7. Optimizing Cloud Computing and Infrastructure

Cloud computing offers immense potential for cost optimization in the software industry. Migrating to cloud-based infrastructures helps enable scalability, flexibility, and cost efficiency. By adopting a pay-as-you-go model, companies can reduce upfront infrastructure investments, minimize maintenance costs, and optimize resource utilization. Whether you are already on the cloud or migrating, the cost savings can range from single digits upwards if best practices are leveraged.

Cloud computing enables companies to optimize resource utilization by dynamically scaling resources up or down based on demand. With the ability to quickly provision and de-provision resources, businesses can match their infrastructure to actual usage, avoiding overprovisioning or underutilization. This elastic scalability ensures efficient resource allocation and cost optimization, as companies pay for resources only when needed. It also enables rapid response to changes in demand, avoiding capacity constraints and potential revenue loss.

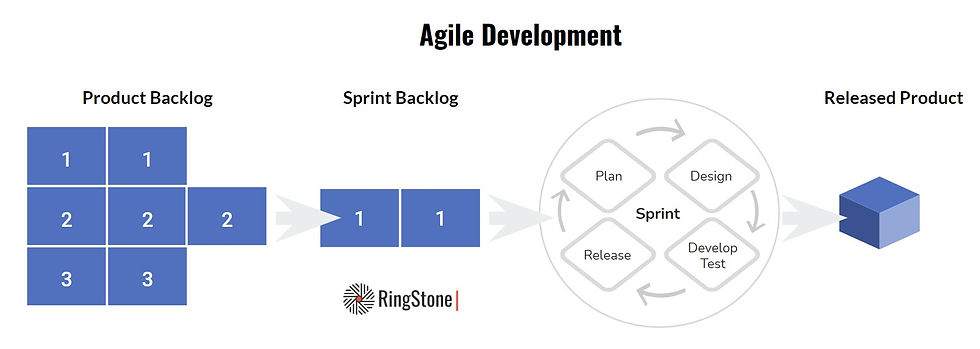

8. Adopting Agile Project Management and Lean Methodologies

Adopting agile project management and lean methodologies can result in significant cost savings for software development projects. Implementing iterative development processes, prioritizing features based on customer value, and continuously monitoring and adapting project scope can enhance productivity, reduce rework, and shorten time-to-market, leading to cost optimization.

Agile Project Management and Lean Methodologies provide frameworks and principles that encourage continuous improvement, collaboration, and waste reduction. By implementing these approaches, organizations can optimize costs by focusing on high-value features, reducing waste, improving productivity, and enhancing overall project outcomes.

9. Prioritizing Projects

Evaluating and prioritizing R&D projects based on their potential for revenue generation, market demand, and strategic fit can ensure that resources are allocated to high-impact projects. In contrast, low-priority or non-core projects are deprioritized or eliminated, saving costs.

This approach allows companies to optimize costs by allocating resources more effectively, avoiding unnecessary expenses, mitigating risks, accelerating time-to-market, and enhancing competitive advantage. This helps ensure that R&D investments align with the company's goals and are more likely to deliver successful outcomes.

Some portfolio companies are weaker in their product management prioritization processes. Here, strengthening product management skills can enhance the R&D project prioritization process by bringing market insights, customer-centricity, data-driven decision-making, cross-functional collaboration, and roadmap alignment. By incorporating these skills, companies can optimize costs by focusing R&D efforts on projects that align with market demand, customer needs, and strategic objectives and have a higher probability of success and revenue generation.

10. Leveraging AI

The potential here is tremendous and is quickly developing, but a few key established benefits are included below. AI (Artificial Intelligence) can play a significant role in helping portfolio companies optimize costs through various applications and capabilities. AI algorithms can analyze vast amounts of data quickly and extract valuable insights. By leveraging AI-powered analytics tools, portfolio companies can gain deeper visibility into their operational and financial data. This enables them to identify cost drivers, detect inefficiencies, and uncover patterns or trends that may go unnoticed using traditional analysis methods.

AI technologies like Robotic Process Automation (RPA) can automate repetitive and rule-based tasks, reducing human effort and improving efficiency. By automating routine processes, portfolio companies can streamline operations, eliminate manual errors, and optimize resource utilization. This leads to cost savings by reducing labor costs, minimizing operational overheads, and increasing process speed and accuracy. AI-driven automation can be applied to various areas, including data entry, invoice processing, inventory management, and customer support.

AI-powered fraud detection systems can analyze large volumes of transactional data and identify patterns indicative of fraudulent activities. By leveraging machine learning algorithms, AI systems can continuously learn and adapt to evolving fraud patterns, reducing false positives and enhancing accuracy. By detecting and preventing fraudulent activities, portfolio companies can mitigate financial losses, avoid regulatory penalties, and minimize reputational damage, contributing to overall cost optimization and risk mitigation.

How Private Equity Firms Can Help Their Portfolio Companies

A private equity (PE) company can assist its portfolio companies in this cost optimization process by identifying issues, analyzing high-spend areas, providing guidance, monitoring progress, facilitating collaboration, and fostering knowledge sharing. By actively engaging with the portfolio companies and leveraging their expertise, the private equity company can support implementing cost optimization initiatives, driving operational efficiency, and maximizing profitability.

One fundamental way the PE firm can help its portfolio companies is by introducing them to a technical due diligence provider to facilitate a deeper dive into the optimization process, for example, by conducting an org and process assessment or technology diagnostic. At RingStone, we have an established methodology that we can deploy quickly and efficiently to identify opportunities to help move the needle. Contact us.

How A Technical Due Diligence Provider Can Help

A technical due diligence provider's expertise and experience in technology assessment and optimization can provide valuable insights to portfolio companies. Their recommendations can guide the companies in making informed decisions on cost optimization strategies, technological investments, and overall value creation.

Three key benefits can be derived by employing a technical due diligence provider.

Objective Evaluation and Benchmarking

A technical due diligence provider brings an objective perspective to cost optimization efforts. They can assess the portfolio company's technology infrastructure, software development processes, vendor relationships, and other technical aspects to identify cost-saving opportunities. By benchmarking the company's practices against industry standards and best practices, the provider can identify areas where costs can be reduced without compromising quality or performance. This objective evaluation helps the private equity firm gain insights into cost optimization potential and make data-driven decisions.

Expertise in Technology Optimization

Technical due diligence providers specialize in technology assessment and optimization. They possess deep knowledge and experience in identifying cost-saving opportunities within technology-related processes and infrastructure. They can recommend strategies to optimize technology investments, streamline operations, and improve efficiency. Their expertise allows them to identify specific cost drivers and provide tailored recommendations to optimize costs while aligning with the company's strategic goals. Leveraging their specialized knowledge, the private equity firm can tap into the provider's advice to drive cost optimization initiatives effectively.

Accelerated Cost Optimization

Engaging a technical due diligence provider accelerates the process of identifying cost optimization opportunities within the portfolio companies. These providers have a structured approach to assessing technology-related costs, risks, and potential savings. Their experience and methodology enable them to identify areas for improvement and develop actionable recommendations. By partnering with a technical due diligence provider, the private equity firm can expedite the identification and implementation of cost optimization initiatives, leading to faster results and increased cost savings for the portfolio companies.

Conclusion

Portfolio companies can achieve sustainable cost savings and improved profitability by understanding the industry landscape, identifying cost optimization opportunities, streamlining operational processes, leveraging technology, optimizing talent and vendors, embracing cloud computing, and adopting agile methodologies. Through these strategies, portfolio companies can create value, enhance competitiveness, and maximize returns.

Private equity firms can support their PortCos by introducing the services of a technical due diligence provider to find ways of optimizing costs within their portfolio companies. Such a provider can bring objective evaluation and benchmarking, expertise in technology optimization, and accelerated cost optimization. By leveraging the provider's specialized knowledge and structured approach, PortCos can effectively identify and implement cost-saving initiatives, driving improved financial performance and value creation.

Explore more thoughts on RingStone’s approach to cost optimization strategies here.

About the Author

Jon White is an experienced technology leader with over 34 years of international experience in the software industry, having worked in the UK, Malaysia, Bulgaria, and Estonia. He holds a BSc (Hons) in Systems Design and led the Skype for Windows development teams for many years (with 280 million monthly connected users), playing a pivotal role in the team's transition to Agile.

Jon has held multiple leadership positions throughout his career across various sectors, including loyalty management, internet telecoms (Skype), IT service management, real estate, and banking/financial services.

Jon is recognized for his expertise in agile software development, particularly helping organizations transform to agile ways of working (esp. Scrum), and is a specialist in technical due diligence. He is also an experienced mentor, coach, and onboarding specialist.

Over the last few years, he has completed over a hundred due diligence and assessment projects for clients, including private equity, portfolio companies, and technology companies, spanning multiple sectors. Contact Jon at jon.white@ringstonetech.com.