RingStone’s Technical Due Diligence

- Demetrio D'Ambrosi

- May 14, 2023

- 12 min read

Updated: Jul 18, 2024

A Perspective On 10 Best Practices For Delivering Business-Aligned Value

Why Is A Business-Aligned Technical Due Diligence Critical To Success?

Technical due diligence is a fundamental part of every M&A transaction, determining the ability of a business to maintain, grow, or integrate its market share after a transaction. It is vital to the success of any investment thesis.

Whether you are an investor with a particular business goal, such as looking to add value to a business (helping it grow its market share or streamline costs through efficiency), or a corporate trade buyer seeking a competitive advantage, performing technical due diligence that is aligned to your goals is essential to achieve the performance you are looking for.

The pandemic has also taught us the need to accelerate digital transformations for survival, where success has rewarded agility and the ability to adjust rapidly to this new reality. Besides technology companies, every business has become technology-driven or technology-enabled with data and an IT backbone. In this context, assessing a company's technical capabilities will help determine the investment thesis viability.

Technical Due Diligence Is Necessary For Both IT-Enabled and Software Companies

Technical Due Diligence enables you to evaluate the technology's suitability to the business and how it can create value through increasing revenue, EBITDA efficiency, company valuation, and potential integration opportunities. To accomplish this, business-aligned diligence, which is aligned to other streams of due diligence, is critically compared to absolute diligence conducted in a vacuum.

In This Article

10 Best Practices For An Effective Diligence

In a previous blog article, we identified several Do’s and Don’ts of TechDD to help companies who are going through diligence to be prepared. In this article, we will focus on ten practical best practices for investor teams and acquirers to maximize the value of Technical Due Diligence.

An effective format for Technical Due Diligence can vary depending on the specific needs and goals of the investor or acquirer, as well as the level of access or competitiveness. However, several key elements are commonly included in the process:

Clear Thesis: Clarity of the investment thesis and goals to incorporate those into the diligence streams, with regular communication cadence for continued alignment.

Early Access: Conducting an Outside-In helps the approach strategy. Timely access to the target company’s management can help surface red flags and areas of deeper focus for the diligence team.

Targeted Preparation: The preparation of an information request list (IRL) provides early insights into how the target company runs and operates. Understanding gaps in the Virtual Data Room (VDR) is equally essential.

Formulate Initial Views: Analysis of the IRL and VDR, in addition to a healthy outside-in complemented with industry research, is a necessary step to formulate a view, understand the hot spots, and identify where the focus areas should be.

Deep-Dive Sessions: The initial views help to structure deep-dive session agendas to understand the gaps, seek clarifications, and provide opportunities for discussions across all technical and functional areas (e.g., Architecture & Code). In addition, they provide exposure and access to the team members and the leadership team. More importantly, they provide a checkpoint to determine the investment thesis viability.

Data Analysis: Significant synthesis is required to analyze the documents, discussions, and notes. This is coupled with data and benchmark analysis efforts to understand the situation top-down and bottom-up.

A 360-View Synthesis: A practical diligence approach should be holistic, with a complementary view of all necessary functional areas (e.g., Architecture & Code, IT Infrastructure, Organization & Leadership, Customer Support, etc.).

Connecting-The-Dots Pragmatically: A key focus is synthesizing the data to connect the dots and truly understand the key risks impacting the business goals. This also helps identify which technology opportunities can move the needle.

Collaboration Is Key: Diligence is an extensive effort for everyone involved, with new information and discoveries surfacing throughout the process. Collaboration and coordination between diligence streams, acquirers, and investors are necessary for continued alignment and to synthesize key insights.

Identify Key Risks & Opportunities: The report should deliver top risks and improvement opportunities with estimated costs and effort to better inform the value creation process, ideally including a roadmap for all stakeholders (e.g., Investment Committee, management team, and the Board) that outlines the mitigation plan for the risks and opportunities identified.

Investment Thesis & Deal Assumptions

Everything starts with the assumptions underlying the deal and the conditions investors want to meet for a successful transaction. Technical Due Diligence must align with the deal's objectives to avoid the pitfalls of “absolute diligence,” presenting a set of irrelevant risks and data that may not be aligned with the goals.

Note: Absolute diligence is one without proper business goals or a thesis that looks at a potential target company without a particular plan.

At the beginning of a project and throughout the assessment, practitioners expect to communicate regularly with the deal team and, when appropriate, other diligence streams for continued alignment as learning continues. A well-articulated set of thesis and business goals statements should be refined as the discovery process progresses since it is a learning process.

The investment thesis often revolves around business goals with technology as an enabler for the target company’s growth potential. In other words, the thesis is tied to revenue (e.g., scale to support X% growth), EBITDA efficiency, and company value. Specific technology goals can supplement the thesis, such as adopting new technologies (e.g., Artificial Intelligence, SaaS Transformation, Cloud Shift, Internet of Things (IoT), and 5G, etc.).

The scope can go beyond the basics and employ strategic initiatives to complement the business thesis and technology exploration to evaluate broader opportunities in IP protection in a dynamic environment. This includes reviewing through the lens of security, regulatory, and political considerations, leveraging the Data Advantage to drive decisions, and looking outside the box by exploring potential disruption opportunities that the specific technology or service approach can enable.

A Business Aligned Thesis Drives A Healthy Tech Due Diligence vs. An Absolute One

Early Access And Thorough Communications With The Target Company

Depending on the deal dynamics and access level, early access is important for open dialog with the target company’s management team to establish mutual trust and foster a productive relationship.

Like any well-executed project, project management and tight communication loops are important. Practitioners need the support of investors to gain access and the appropriate level of attention from the target company’s executives. These executives are busy running their businesses and are typically overwhelmed with the diligence process, especially in small and medium-sized companies.

During a transaction, the pressure on the target company’s executives is exacerbated by juggling day-to-day activities and the extra demands from multiple streams of due diligence. It’s common to push back on requests for their time. Those early management discussions can be an opportunity for practitioners to assess the senior leadership team and understand the company’s vision in more depth and the company's ability to navigate challenges and capitalize on opportunities in the future.

Information Request List (IRL) and Virtual Data Room (VDR)

In any organization, well-crafted documentation is the foundation for efficient execution, enabling collaboration and employee onboarding. However, not all companies will have a perfect scenario. It is equally important to understand what is in place and what is not in place to surface insights and gaps.

The design and content of a well-structured information request list (IRL) is key to successful technical due diligence. It should be tied strategically to the business thesis and key insights needed to explore and potentially align with other diligence streams for efficiency.

One size doesn’t fit all and is expected to be an incremental, iterative process. A big laundry list at the start can be overwhelming and ineffective. Expecting the target company to create net new materials for diligence shortcuts the understanding of their situation and does not reflect reality. The IRL should also be tailored to reflect the size and complexity of the business. Based on the level of maturity, smaller companies might have more or less structured information available.

Particularly for technical documentation, it is often more helpful to show and tell (e.g., exploring Jira, Trello, GitHub, etc.) to provide insights into the company's day-to-day workings. Those interactions complement and validate what is provided in the VDR and are critical to the assessment process.

IRL Gaps Are Equally As Important As What’s In the VDR

The Discovery Meetings & Synthesis

Perhaps the most profound part of any diligence is the deep-dive discovery sessions, during which the practitioners and investment teams learn, understand, explore, and pressure test all assumptions across the functional areas (e.g., IT Infrastructure) in scope.

Enabling a successful deep dive starts with a clear and customized agenda that is also flexible in its structure to promote a healthy discussion and the ability to pivot when needed.

The agenda should be shared with the target company in advance, outlining business-aligned key topics from a technology perspective, and suggested attendee roles. This enables preparation and broader exposure in the organization when appropriate.

Depending on the size of the business and the depth and scope of the diligence, conduct interviews with functional managers and leaders, key stakeholders and decision-makers, and any advisors or experts who may be involved in the process. After the discovery meetings, schedule follow-up meetings with the target company to clarify questions and request additional information when necessary.

Perhaps one of the important aspects is to formulate an initial view after the discovery sessions and explore the reaction of the deal team or acquirer. This may be to share key red flags, such as insights that may result in a pencils-down scenario (i.e., the diligence team pauses on project execution) if the findings conflict with the investment thesis.

Without “deal-breaker” red flags, the analysis phase examines the wealth of data and information gathered before, during, and after the discovery sessions. Here, the diligence team connects the dots across functional areas and ties those to the thesis, financials, and, when appropriate, findings from other diligence streams. This extensive phase culminates in synthesizing salient points, prioritizations, identifying a backlog of risks, and value-creation opportunities to guide the investment forward.

Technical Due Diligence Discovery Enables Decisions And Profound Validation Depth

Checkpoints

In most deal transactions, speed and efficiency of execution are necessary. Extensive communication among team members, consultants, practitioners, and investment leaders is the key to a successful outcome, whether closing or walking away. As the process progresses, the various streams of diligence will keep uncovering information and issues that need to be addressed and investigated immediately to avoid surprises later in an already tight timeframe.

Technical Due Diligence Project Management & Continuous Alignment Is Important

Value Creation

Value creation opportunities in due diligence constitute the potential ways an investment can generate a return and increase the value of a business or asset. During the diligence process, investors and potential acquirers seek to identify these opportunities and assess their potential impact on the investment as needle movers where they can add more value.

The team of experienced practitioners can provide a roadmap of the key investments necessary for the remediation, stabilization, future-proofing, and staffing of key personnel. These recommendations consider the investment thesis, size and maturity of the business, industry benchmarks, and their potential impact on the bottom line (e.g., revenue growth, EBITDA efficiency, and growing company value).

Some common value-creation opportunities include:

Technology And Innovation: Investing in new technologies or innovative approaches can lead to improved operations, increased efficiency, and competitive advantages.

Improving Efficiency: Improving agility, processes, and systems can increase productivity, reduce waste, and increase the efficiency of operations, leading to cost savings and improved profitability.

Risk And Remediation Strategies: Identifying the areas that require attention on Day 1, prioritized for urgency and value, with detailed costing of the necessary investments.

Optimizing Assets: Evaluating asset utilization and allocation can help identify opportunities for asset optimization, such as selling underutilized assets or reallocating resources to more productive uses.

Cost Savings: Identifying and implementing cost-saving measures, such as streamlining operations, reducing expenses, or improving supply chain efficiency, can increase profitability and drive value creation.

Revenue Growth: Technology can provide opportunities for revenue growth that can include expanding into new markets, launching new products or services, enabling cross-sell or up-sell, or improving product strategies.

M&A Integration Readiness: Analyzing readiness for further M&A integration with existing portfolio companies or future targets, as strategic acquisitions or mergers can provide an opportunity to combine complementary businesses, create collaboration, and drive growth and value creation.

Limiting Disruption: Perhaps the most important one to consider with a future lens is whether the technology of a company can easily be replicated or disrupted. This requires a broader understanding of the market, competitors, and ecosystem to determine the level of potential risk.

A Healthy Tech Due Diligence Identifies Value-Add Opportunities In Addition To Risks

The Technical Due Diligence Report

Before issuing the report itself, the acquirer or investor should already have a level of comfort about the risks involved to eliminate any surprises. Ultimately, the report should serve multiple stakeholders, including the deal team, the investment committee, other diligence streams, other 3rd-party stakeholders, and, optionally, the target company (as some investors may later share the report with the target company).

The technical due diligence report provides comprehensive business analysis and is used to support informed investment or acquisition decisions. Here are some key elements included in a technical due diligence report serving all stakeholders.

Executive Summary: A high-level summary of the key findings and recommendations, including the business's current and desired future state. This would include an overview of the maturity of the functional areas being assessed. The summary is also where all the Technology Due Diligence aspects come together in a cohesive story that “connects the dots.” This will cover the strategic and economic implications of findings, risks, and opportunities. It summarizes value creation initiatives and how these relate to revenue growth, EBITDA, and exit multiple potential.

Summary Of Investment Risks/Opportunities & Benchmarks: This is tailored to inform the investment committee, providing a succinct summary of the key investment risks and opportunities, identifying big rocks and needle movers. The benchmarks are useful to compare the target company against the industry across several KPIs, helping the investor understand the target company’s relative health.

Risks And Opportunities Backlog: This backlog serves the deal team and the target company. Ultimately, it identifies in detail the areas that require attention with a step-by-step guide to address them. These also include a stack-ranked priority and urgency on what is critical on day one versus the nice to have, low-hanging fruit opportunities to improve operations after closing.

Value Creation Roadmap: The report is also an opportunity to connect the dots and provide a holistic view, explaining the technology from a business lens. The Value Creation Roadmap may consider multiple levers from the business point of view (e.g., delivering a graduated 3-phase approach, including immediate, short-term, and long-term value).

Supporting Details & Analytics: The report would provide a comprehensive analysis of the functional areas, supporting documentation, and data that support the findings, but also can serve as a guide for the target company to consume and gain insights from a 3rd party assessment. Functional areas would typically include Product Roadmap & Strategy, Architecture, Infrastructure, Software Development Lifecycle, Organization & Leadership, Cybersecurity, and Customer Support. There may be additional add-ons that may explore in more depth, depending on the target company (e.g., AI/ML).

A Technical Due Diligence Report Must Serve Multiple Stakeholders

Conclusion

Technical due diligence is as much an art as a science. It requires flexibility, pivoting, a pragmatic view of technology using a business lens, excellent project management, strong technical and business acumen, and real-world experience. A business-aligned technical due diligence is critical to success because this alignment helps identify business-appropriate risks, explore opportunities to create more valuable and efficient companies, and optimize value for stakeholders. Ultimately, business-aligned technical due diligence enhances the quality of the investment thesis, the relevance, and the outcome of the assessment, optimizing the investor's decision-making process.

The RingStone Advantage

Combining deep technical horsepower, business acumen, and years of execution experience working with investors and companies, coupled with hands-on teams globally, a well-developed process, industry benchmarks, and tools to support best practices and align teams, RingStone has a unique competitive edge.

RingStone’s advantage is in our approach, which combines people, processes, and tools. Our team comprises senior technical experts, such as CTOs, with solid business acumen, complemented by proprietary software and industry & best practice data. These combine to help RingStone deliver the best value for our clients, with a pragmatic focus on practical risk mitigation and value creation.

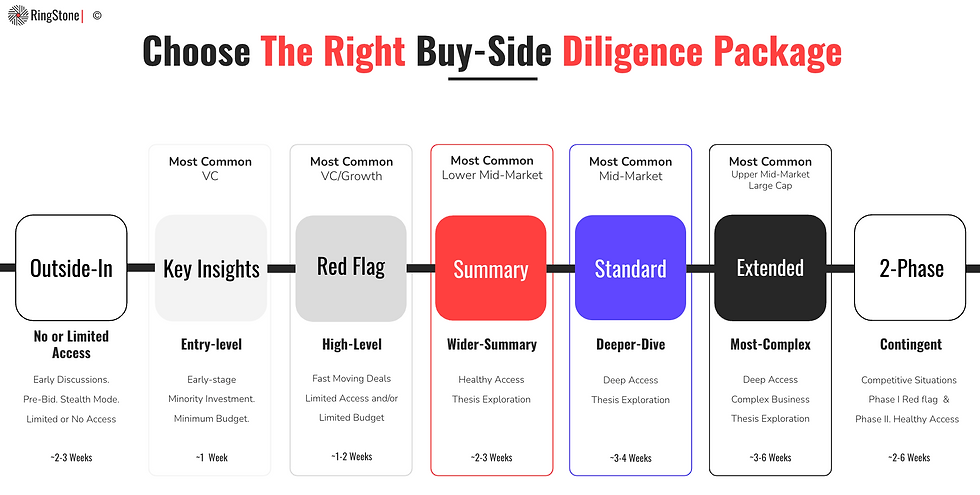

Whether there is limited access that requires an outside-in approach, a competitive deal with a compressed timeline that requires a red flag due diligence, or a need for a deeper dive that requires standard due diligence, RingStone offers multiple diligence packages to accommodate the needs of specific situations and different budgets.

RingStone’s agility, nimbleness, and geographic footprint allow us to mobilize quickly and accommodate fast-moving deals.

Diligence packages are tailored based on the target company’s situation, stage, size, revenue, maturity, and, more importantly, the investment strategy and goals. We help investors decide which package is best for their situation.

About The Author

Demetrio has a technical background and deep business experience in modern technology, software development, and product management. He has worked with several technology startups worldwide, facilitating and executing product strategies and partnerships and developing executive teams during high-growth stages to sustain rapid expansion and successfully drive innovation.

Demetrio has been involved in the software development industry in many functional roles, being a Product Manager, a Test Manager, a Strategy Manager, and a COO while also staying active in the M&A industry. He has created and launched many products at Microsoft during a 20+ years tenure.

Today, he is a Practitioner at RingStone, working with private equity firms and portfolio companies in an advisory and operating capacity, leading Technology Due Diligence and pre- and post-transaction activities.

Contact Demetrio at demetrio.dambrosi@ringstonetech.com

![Technical Due Diligence Checklist & 85 Areas for Tech Due Diligence Questions [2024]](https://static.wixstatic.com/media/9ee0dc_6ac2aa4f62064089847e351498328046~mv2.png/v1/fill/w_799,h_527,al_c,q_90,enc_avif,quality_auto/9ee0dc_6ac2aa4f62064089847e351498328046~mv2.png)

![Ultimate Tech Due Diligence Checklist & Tips: Ensuring Investment Readiness [2025]](https://static.wixstatic.com/media/e8c180_49672f331e2e4d9fa39678af61b6df3e~mv2.png/v1/fill/w_980,h_512,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e8c180_49672f331e2e4d9fa39678af61b6df3e~mv2.png)